Posts Tagged ‘401k tips’

BeManaged December Market Research Newsletter – Domestic Stocks Flat in November

The following are some topics covered in this month’s Research Newsletter from the BeManaged Research Department.

Domestic Stocks Flat in November

Is It Possible They are Going Too Fast?

Estimating Your Retirement Income Adequacy

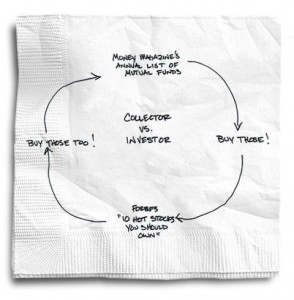

Are You an Investor or a Collector?

Our friend Carl Richards of BehaviorGap.com and the NYTimes.com Bucks blog has done a great job of illustrating how the ‘over diversification’ of portfolios can simply be ‘buying more’ instead of ‘buying different.’

Over- or under-diversifying your investments remains one of the classic behavioral mistakes.

Over-diversification happens when we become collectors of investments instead of simply being investors. Think of the people who buy the mutual funds they read about in Smart Money magazine. Next year they buy the Top 10 Funds recommended by Money magazine. A year later they buy two or three new international funds because that’s what’s on the home page of Forbes.

Read MoreBeManaged November Market Research Newsletter – What’s Another $600,000,000,000?

The following are some topics covered in this month’s Research Newsletter from John Whaley, CFA, AIF, Director of the BeManaged Research Department.

What’s Another $600,000,000,000 Among Friends?

Good News for Dividend Collectors

Consumers Continue to Lack Confidence

2011 IRS Contributions Limits for Your 401k/403b

Last week, the IRS released the contribution limits for 401k/403b investors, and the amounts remain unchanged for 2011. Here are the numbers:

Elective Deferral (traditional limits) – $16,500

Catch-up Contribution for Investors 50 yrs and Older – $5,500

The reality is, your contributions to your 401k/403b is the #1 reason for your success as an investor. Here are some strategies for increasing your contributions:

BeManaged October Research Newsletter – Asset Class Correlations and Your Portfolio

The following are some topics covered in this month’s Research Newsletter from John Whaley, CFA, AIF, Director of the BeManaged Research Department.

Third Quarter Ends on Positive Note

Pension Plans Continue Rosy Expectations

Asset Class Correlations and Your Portfolio

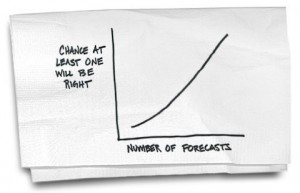

Market Forecasts, a.k.a. Market Guesses

Soothsayer. Prognosticator. The illusory crystal ball. The market forecasts that are lauded by the media…whose goal is to sell advertising…are simply speculation. We have told investors since day one that no one truly knows what the market is going to do by the end of the week, month or year. If you meet someone that claims they do…run…in the oppositive direction. Fast.

Read More3 Ways to Spot a Bad Investor (Video)

CBS Marketwatch.com just put out a handy little video to help identify whether you, your friend or your advisor is a bad investor. It’s brief, and definitely true.

Read MoreBeManaged September ‘10 Research Newsletter – Safety Prevails

The following are some topics covered in this month’s Research Newsletter from John Whaley, CFA, AIF, Director of the BeManaged Research Department.

Bonds Remain Asset Class of Choice

FDIC Quarterly Bank Profile Provides Positive News

What to Make of Consumer Spending Trends

It’s Official – We Are Finally BeManaged.com

Here’s a suggestion to businesses…get your business name correct from the get go. Just sayin’. Rebranding is a big job, even for small businesses such as us. That being said, the transition is complete as we have finished the migration to BeManaged.com (we think, anyway). Any links you have bookmarked should still come to our site or the appropriate file. We apologize if you have experienced any confusion or issues over the past few weeks.

Read More5 Reasons NOT to Tap Into Your 401(k)

Times are tough. People are over-extended. Sometimes desperation can lead us to consider our 401(k) as a savings account that could save the day. Our 401(k) should be the LAST option for cash. Here are five reasons reinforcing why this is a really bad idea, straight from CBS MoneyWatch’s “Evil HR Lady”, Suzanne Luc

Read More