Market Forecasts, a.k.a. Market Guesses

Soothsayer. Prognosticator. The illusory crystal ball. The market forecasts that are lauded by the media…whose goal is to sell advertising…are simply speculation. We have told investors since day one that no one truly knows what the market is going to do by the end of the week, month or year. If you meet someone that claims they do…run…in the oppositive direction. Fast.

Soothsayer. Prognosticator. The illusory crystal ball. The market forecasts that are lauded by the media…whose goal is to sell advertising…are simply speculation. We have told investors since day one that no one truly knows what the market is going to do by the end of the week, month or year. If you meet someone that claims they do…run…in the oppositive direction. Fast.

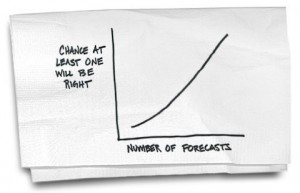

As the article by our friend Carl Richards illustrates, given enough opportunities and guesses, even I can tell you on which number the roulette ball is going to land.

With very few exceptions, market and economic forecasts are really nothing more than guesses. But as we continue to reckon with an uncertain economic future, it is more tempting than ever to seek out a guru. We want someone to tell us what is coming so we can plan accordingly.

As you read these forecasts here are a few things to keep in mind:

1. No one knows what the future holds. History doesn’t really help except to tell us that it’s hard to forecast accurately.

2. If people make enough guesses, they are bound to get at least one right.

3. If you nail a big guess as a market forecaster, you can milk it for a long time. Think of all the people that have come out of the woodwork claiming to have forecast the collapse of 2008. Sure a few of them actually did get it right, but the dilemma for us is trying to figure out if they got it right based on skill or if they were just lucky.

4. Forecasters who got one big guess right might not be right the next time. In fact, the process they used to diagnose a problem in the past might increase the chance they will be wrong in the future. After all, the next big problem probably will not look like the one in the past that they managed to spot.

Just to be clear, I’m sure that there are thoughtful economists that provide useful insight. I just don’t know of anyone that can reliably tell me who they are. So little history, and so many guesses.

Next time you are tempted to make very important decisions based on the latest guess by the media’s current favorite guru, remember the old saying that even a broken clock is right twice a day.

I always say that if someone tells you he knows where the markets are going he is either lying to you or lying to himself and in reality it is probably both.

Great stuff Chad thanks for sharing

People need to understand that most of the time your are going to get what the market gives. Sometimes people get lucky, but over the long haul it all seems to even out.

Agreed. Bur participants (and trustees for that matter) always want SOMETHING they can hang on to. What have you been telling people?

As Alex Trebek says, “Can you rephrase that in the form of a question.” That way, people might understand why it’s important to read the story.

Chad, can you tell us how your article outlines a challenge to fiduciary’s? I could think of a couple of ways, but you get first dibs.

Great comments and questions all around.

Steve, being a 401k participant-only fiduciary, we focus on reminding participants that there are only 3 things they can control: risk, contributions and their behavior. Thus, focusing on their ‘recipe’ (asset allocation), we can help ‘control’ their portfolio’s risk exposure by working along the target allocations we establish based on their investor profile. We will often say, “While everyone has an opinion of the market, no one knows what the market is going to do at the end of the week, month or by the end of the year. However, our research department does monitor risks and opportunities in the market in order to take advantage or protect our clients from such situations. However, they will be the first to tell you that NO ONE knows what will happen from one day to the next. All we can do is make reasonable, prudent judgments decisions on how to adjust your recipe based on our outlook on the market.”

Does that make sense? I think everyone has an opinion, it’s simply a matter of how they articulate it, and then whether they consider themselves soothsayers for saying so. As we all know, these types of comments in the media are a function of the fact that ‘sex sells’ in the investment world. The perception of an investment guru/market maven is simply an easy thing to sell to investors’ greed.

Chris, I think it’s important to remember that a plan trustee is also a participant. Just because they have the title does not mean they are not also prone to make the same mistakes ‘Joe Participant’ will. Many people have had the experience of ‘falling for’ the ‘silver bullet’ proposed by a self-proclaimed guru. This is simply a reminder to focus on what is reasonable, which is understanding that NO ONE can predict the market day in and day out, and that managing risk, contributions and our behavior is effectively all we can do.

Fabulous. We do pretty much the same, having participants agree on a strategy and then making an effort to stay with the strategy. We do like to use the Callan chart to show how hard it is to “guess”…like Wack-A-Mole if you have that arcade game around…but if you buy thet whole chart you can do well (different weightings for each category, of course).

Wack-A-Mole…that’s fantastic. I might have to use that one.

Maintaining a plan, that is sticking to it is likely as big a problem. Knowing the money personality of the investor helps to keep them straight especially in difficult times.

I agree with you. Here’s the difference, though. When a participant makes a mistake mindlessly following the headlines, he only impacts himself. When a plan sponsor or other fiduciary makes a similar mistake, he impacts the entire plan and exposes himself to increased liability. That’s why what you’re writing about is so important. I’m sure there’s studies out there that show plan sponsors are more concerned with priorities other than their plan (like keeping their business profitable, health care, etc…) That makes them more susceptible to fall for the latest guru’s comments.

I ask why they want to know. What will change how they go about their business? As Mark Twain once lamented: “the art of lying is no longer done with any skill. He wrote: for the Lie, as a Virtue, A Principle, is eternal; the Lie, as a recreation, a solace, a refuge in time of need, the fourth Grace, the tenth Muse, man’s best and surest friend, is immortal, and cannot perish from the earth while this club remains.”

If someone asks, it is because they want to be lied to. We know that only children and fools speak the truth – and when it comes to the market, none of us wants to ask a child or a fool.