Posts Tagged ‘401k tips’

BeManaged May ’10 Research Newsletter – Red Flags that Deserve Attention

The following are some of the highlights discussed in the May ’10 Research Newsletter from John Whaley, CFA, AIF, Director of the BeManaged Research Department.

Read MoreConsidering a Roth Conversion? Avoid the Crooks

When we hear about 401(k) investors moving all or a portion of their account to an IRA, the question becomes, “What did they invest you in?” Now, with the new tax law that enables investors to more easily convert their traditional IRA assets to a Roth IRA, brokers, insurance agents, and other financial product salespeople…

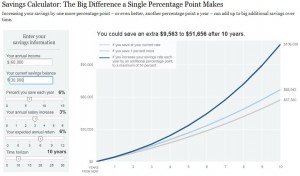

Read More401(k) Investors’ Achilles Heel #3: Expecting Investment Performance to do All of the Work

I have to give it to the NYTimes. Their new “Bucks” blog includes great insight from our friend Carl Richards of BehaviorGap.com. Just yesterday they posted a very easy to use, interactive 401(k) savings calculator that illustrates how increasing your contributions just 1% creates a very different retirement picture for you upon retirement, while avoiding…

Read MoreWhy There Are No ‘Best’ Investments – BehaviorGap @ NYTimes

As you know, our friend Carl Richards is a writer for NYTimes.com. We have definitely encountered people trying to find the “silver bullet” investment that will magically create huge gains for their 401(k). Unfortunately, this typically results in some really outlandish investment “strategies” and chasing the performance of the “best fund.” The cost of those decisions to their nest egg is tremendous. The following is Carl’s most recent post, and I won’t try to water it down with a summary, for I think every investor should read it.

Read MoreBeManaged April ’10 Newsletter – Stocks Accelerate and the Use of Bonds/Money Markets in Your 401(k)

The following are some of the topics discussed in this month’s newsletter from John Whaley, CFA, AIF, the Director of our Research Department.

Stock Gains Accelerate in March

Trends in Savings and Investments Among Workers

Use of Stable Value/Money Market Funds and Bond Funds in Your Retirement Portfolio

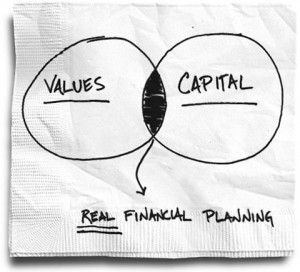

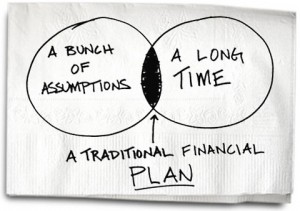

401(k) Investors’ Achilles Heel #2: Goal-Based Investing – Good or Bad?

This month, our team has conducted dozens of 1-on-1 consultations. During these consultations, we walk the 401(k) investor through an investor questionnaire that takes into account their age, time horizon for accessing their 401(k) assets, and their risk tolerance. During this review of their account, we consistently run into investors who have an expectation of what they need to achieve from a performance standpoint in order to meet their goals. Just as I was considering this, Carl Richards wrote an article (click the napkin to read) specific to whether financial plans are worth the paper they are drawn up on.

Read More401(k) Investor Achilles Heel #1: Overconfidence

From time to time, all of us think we know what we are doing when clearly we do not, but it is not until we are proven wrong that we come to realize it. For me, it’s home repair. I know it’s not my strong suit, but my “man” button keeps blinding me to that fact until I am calling the repairman to fix the original problem and everything additional that I destroyed, broke, etc.

That, my friends, is humility. And humility is good for all of us. When it comes to investing, such overconfidence in our abilities can be extremely costly. In fact, the larger the balance of your 401(k), the more costly mistakes can be to you.

Read MoreBeManaged March ’10 Newsletter – The Advancing US Dollar and Your 401(k)

The following are some of the topics discussed in this month’s newsletter from John Whaley, CFA, AIF, the Director of our Research Department.

Advancing US Dollar Translates to Declining Foreign Stock Returns

Mutual Fund Fees and the Impact on Your Acccount

How Does Your 401(k) Account Growth Compare?

Brokers Win, Investors Lose Key Reform – WSJ

Every investor working with a financial planner/wealth manager/financial advisor/stockbroker…whatever title is used…should read at least the following quote. In Jason Zwieg’s article on WSJ.com, he provides one of the easiest to understand summaries I have read on the responsibility that person has to you:

As of now, the roughly 630,000 brokers, bankers and insurance agents registered to sell securities must determine whether investments are “suitable”—based on how wealthy you are, what else you have invested in, your tax status and your investment objectives.

Securities salespeople generally aren’t obligated to act in your best interest. They needn’t tell you that they make extra money pushing one particular investment or that cheaper alternatives might provide you a higher return.

Suppose two mutual funds are “suitable,” but one of them pays the broker a fatter fee. You may well end up in that one—without finding out that your broker had an incentive to favor it.

On the other hand, financial advisers—who are regulated as “fiduciaries” under the federal Investment Advisers Act—are obligated to put you first. They must explain their fees, disclose conflicts of interest and disclose past infractions. If they get paid extra to recommend a fund or sell an insurance product, they have to tell you.

Read MoreStudies Show the Less You Do With Your 401(k), the More You Earn

ometimes, it helps to hear this from an independent source…

Don’t take this too personally, but the less you are involved with investment decisions for your 401(k) the better off you may be.

Sometimes, it helps to hear this type of thing from an independent source. As we have said before, we don’t fix our own cars, why should we be expected to be professional investment managers?

Don’t take this too personally, but the less you are involved with investment decisions for your 401(k) the better off you may be.

A new study of more than 400,000 401(k) participants in seven corporate plans found that the median return earned by individuals who sought out help in managing their 401(k) was 1.86 percentage points more than participants who made their own allocation/investment decisions.

Read More