Posts Tagged ‘BeManaged Newsletter’

How to Review the Performance of your Investments

Your investment statements are arriving, so many of us will take a look at our investment accounts to see how we (or our advisor) did. Unfortunately, it can be a bit confusing to determine if we did well, average or poorly. Let’s look at the items that will help you determine how you did. How…

Read MoreThe Incredible, Levitating S&P 500

April 2016 – The Incredible, Levitating S&P 500 After a rough start to the year, the S&P 500 rebounded in March erasing prior losses and turning in a 1.3% gain in the first quarter. As you see below this measure of stock market returns has increased 11% during last three and five year periods, significantly…

Read More2015 Ends as a Wash for Investors

January 2016 After All the Twists and Turns, 2015 Ends as a Wash for Investors But That Should Not Impact Your Savings Strategy Whether you look at the returns by different types of investments shown on the right, or just take a peek at your retirement account statement when received, you know that last year…

Read MoreFall 2015 Newsletter

Market Volatility and Investor Behavior The significant downside volatility in world stock markets during the third quarter of this year reminds us of one simple fact: No one knows what the market is going to do next. Investors need to prepare ahead of time, in both their portfolios and their mindsets, for likely market behavior.…

Read MoreSummer 2015 Investment Notes

Findings from the Latest Retirement Confidence Survey Sponsored by the Employee Benefit Research Institute (EBRI), the American Savings Education Council (ASEC), and Mathew Greenwald & Associates (Greenwald), the annual Retirement Confidence Survey is a random, nationally representative survey of 1,000 individuals age 25 and over. Below we present a few interesting findings from the April,…

Read MoreJune 2015 – Take Our 1-Question Downside Risk Quiz

Our Risk Quiz – How Much Money are You Comfortable Losing? How would you answer the following? You are 55 years old and have managed to accumulate $337,400 in your retirement savings account. During the next market correction, how much of that balance are you willing to lose? $0 $25,440 $37,400 $67,480 $158,900 The last…

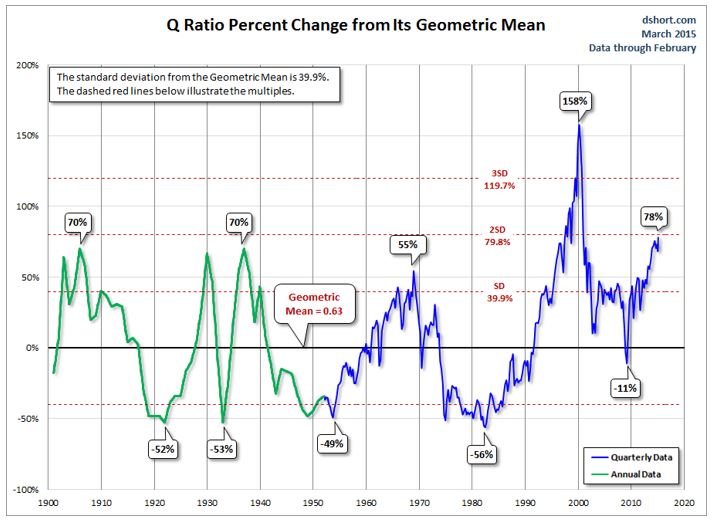

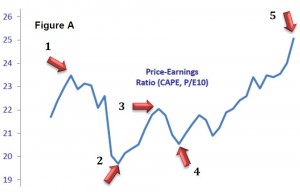

Read MoreApril 2015 – Starting Points Matter

Just a Reminder – Starting Points Matter Investors continue to insist on paying ridiculous prices for common stocks, investment grade bonds, and the funds that invest in them. The financial salespeople (those NOT acting as fiduciaries for your assets) continue to tout justifications for these high prices by citing statistics that have absolutely no historical…

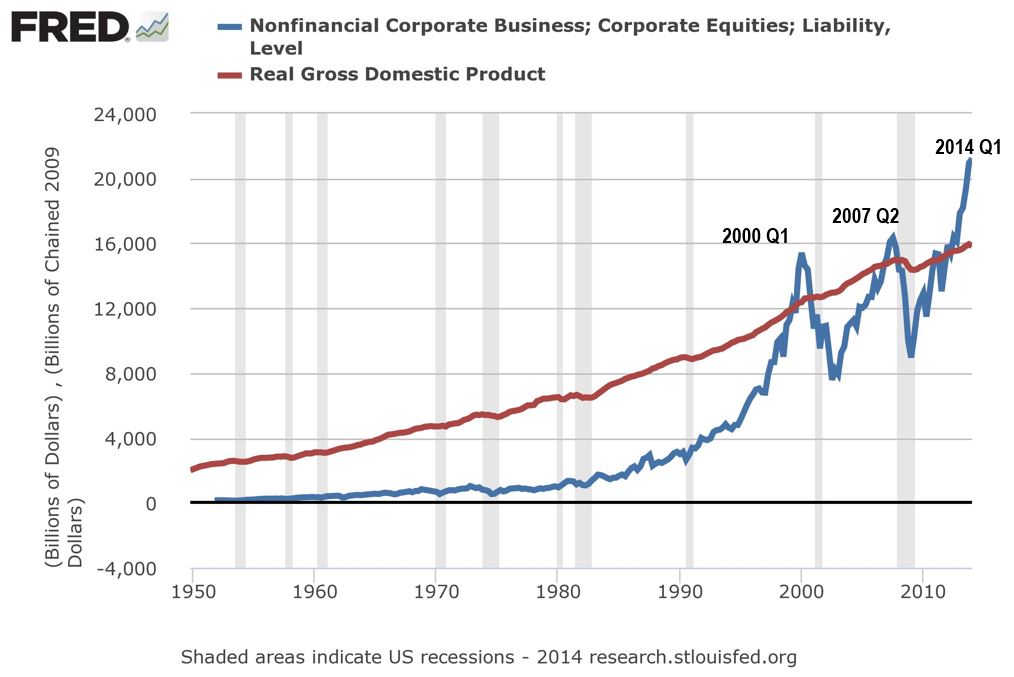

Read MoreSummer 2014 Newsletter – Market Value of Stocks Now Exceeds GDP

Market Value of our Stocks Now Exceeds Total Value of our Production Investors find themselves today in a climate of high and climbing stock prices. There are many potential causes. Individual companies may out-perform expectations and therefore justify a higher price, or the economic growth of the nation may create an environment where stock prices…

Read MoreDecember Newsletter – Tis the Season for Chasing Returns

How Investment Bubbles Work “Keep in mind how investment bubbles work. A bubble always starts with some real factor that takes on increasingly exaggerated importance in the eyes of investors. The bubble expands not on facts but on untethered imagination. People imagine that X will result in ever-increasing prices, and assume that an endless crowd…

Read MoreNovember Newsletter – Your Willingness, Ability and Need to Accept Risk

Your Willingness, Ability and NEED to Take Risk For our best savers, risk can and should be reduced When enrolling in our service, our clients are asked a short series of questions designed to help us understand the level of risk appropriate for their investment portfolio. Our goal is to best understand (at least initially),…

Read More