Posts Tagged ‘personal finance’

401(k) Investing, Diversification and Asset Allocation – In Plain English

The BeManaged Ingredients and Recipe Investment Analogy

Over the past number of years I have come to really enjoy cooking. It unknowingly led me to an analogy for investing that is simple to understand and better yet, visual. The analogy, consisting of ingredients and the underlying recipe, has helped hundreds of investors better understand what they can ‘control’ within their 401(k). Furthermore it helps investors understand confusing terms such as “diversification” and “asset allocation” and how they impact the ‘behavior’ of their portfolio.

Read MoreBeManaged August ’10 Research Newsletter : Capital Disappearing in Private Sector

The following are some highlights discussed in the August ‘10 Research Newsletter from John Whaley, CFA, AIF, Director of the BeManaged Research Department.

Equities Gain Over 7% in July

The EBRI Retirement Readiness Rating

Capital is Disappearing in the Private Sector

401(k) Investors Achilles Heel #4 – Managing Risk Through Contributions

One of the biggest issues we see during this time is people will stop their contributions when the market takes a down turn, and then contribute again once the market is doing “better.” Unfortunately, as with the other achilles heels we have discussed, this is the exact opposite thing 401(k) investors should do.

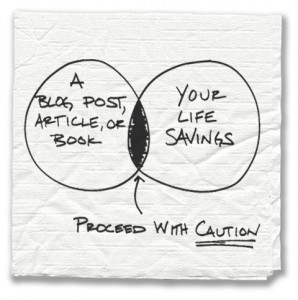

Read MoreIgnore Generic 401(k) Guidance Posed as Advice

We have seen people follow guidance from the likes of the Jim Cramers, Suze Ormans and Dave Ramsey (though we are big fans of his debt reduction advice), which more often than not steers people into an inappropriate portfolio. Many 401(k) providers will even provide some general guidance as well, but they leave investors to figure out the ideal recipe (asset allocation) to create from their plan’s ingredients (investment options).

Read MoreBeManaged July ’10 Market Outlook Newsletter – Second Quarter Ends with a Thud

The following are some highlights discussed in the July ‘10 Research Newsletter from John Whaley, CFA, AIF, Director of the BeManaged Research Department.

Second Quarter Ends with a Thud

Another Review of Long-Term Market Value

A Picture of Risk

BeManaged June ’10 Research Newsletter – Govt. Finance Bubbles Hit World Markets

The following are some of the highlights discussed in the June ‘10 Research Newsletter from John Whaley, CFA, AIF, Director of the BeManaged Research Department.

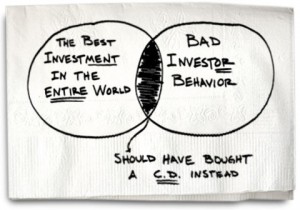

Read MoreAre All Investment Mistakes Investor Mistakes Instead?

Carl Richard’s latest article brings up a very interesting perspective on investing. The following sums is up pretty well,

We’re quick to focus on the reward but fail to appreciate the consequences of our choice. If an investment performs well, we like to think, “I picked a winner.” If it’s the reverse, and the investment fails, it’s someone else’s fault.

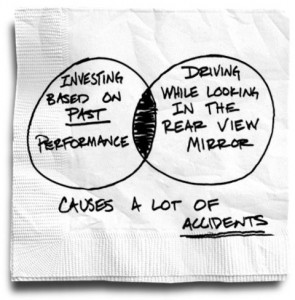

Read MoreThe Temptation (and Danger) of Past Investment Performance – NYTimes Bucks Blog

It’s understandable. You are looking to invest in something different in your 401(k), and what is the most accessible bogey to judge the funds in your plan? Past performance. It tugs at the foundation of human nature, greed and fear.

Read MoreBeManaged May ’10 Research Newsletter – Red Flags that Deserve Attention

The following are some of the highlights discussed in the May ’10 Research Newsletter from John Whaley, CFA, AIF, Director of the BeManaged Research Department.

Read MoreConsidering a Roth Conversion? Avoid the Crooks

When we hear about 401(k) investors moving all or a portion of their account to an IRA, the question becomes, “What did they invest you in?” Now, with the new tax law that enables investors to more easily convert their traditional IRA assets to a Roth IRA, brokers, insurance agents, and other financial product salespeople…

Read More