Posts Tagged ‘personal finance’

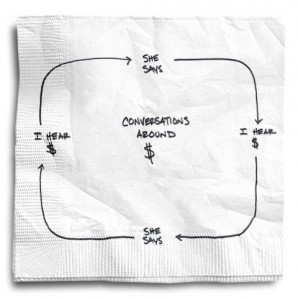

Conversations About Money…Even When They Are Not

If you follow this blog at all, you know I am a fan of Carl Richards, who does a fantastic job of simplifying investing concepts but also our behaviors around money. The following post from the New York Times is a fantastic example and advice from which we can all (mostly us men) can benefit from.

Read MoreBeManaged December Market Research Newsletter – Domestic Stocks Flat in November

The following are some topics covered in this month’s Research Newsletter from the BeManaged Research Department.

Domestic Stocks Flat in November

Is It Possible They are Going Too Fast?

Estimating Your Retirement Income Adequacy

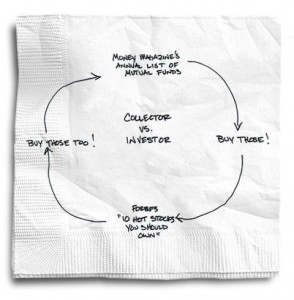

Are You an Investor or a Collector?

Our friend Carl Richards of BehaviorGap.com and the NYTimes.com Bucks blog has done a great job of illustrating how the ‘over diversification’ of portfolios can simply be ‘buying more’ instead of ‘buying different.’

Over- or under-diversifying your investments remains one of the classic behavioral mistakes.

Over-diversification happens when we become collectors of investments instead of simply being investors. Think of the people who buy the mutual funds they read about in Smart Money magazine. Next year they buy the Top 10 Funds recommended by Money magazine. A year later they buy two or three new international funds because that’s what’s on the home page of Forbes.

Read MoreBeManaged November Market Research Newsletter – What’s Another $600,000,000,000?

The following are some topics covered in this month’s Research Newsletter from John Whaley, CFA, AIF, Director of the BeManaged Research Department.

What’s Another $600,000,000,000 Among Friends?

Good News for Dividend Collectors

Consumers Continue to Lack Confidence

2011 IRS Contributions Limits for Your 401k/403b

Last week, the IRS released the contribution limits for 401k/403b investors, and the amounts remain unchanged for 2011. Here are the numbers:

Elective Deferral (traditional limits) – $16,500

Catch-up Contribution for Investors 50 yrs and Older – $5,500

The reality is, your contributions to your 401k/403b is the #1 reason for your success as an investor. Here are some strategies for increasing your contributions:

BeManaged October Research Newsletter – Asset Class Correlations and Your Portfolio

The following are some topics covered in this month’s Research Newsletter from John Whaley, CFA, AIF, Director of the BeManaged Research Department.

Third Quarter Ends on Positive Note

Pension Plans Continue Rosy Expectations

Asset Class Correlations and Your Portfolio

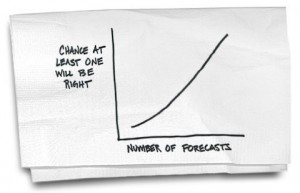

Market Forecasts, a.k.a. Market Guesses

Soothsayer. Prognosticator. The illusory crystal ball. The market forecasts that are lauded by the media…whose goal is to sell advertising…are simply speculation. We have told investors since day one that no one truly knows what the market is going to do by the end of the week, month or year. If you meet someone that claims they do…run…in the oppositive direction. Fast.

Read More3 Ways to Spot a Bad Investor (Video)

CBS Marketwatch.com just put out a handy little video to help identify whether you, your friend or your advisor is a bad investor. It’s brief, and definitely true.

Read More5 Reasons NOT to Tap Into Your 401(k)

Times are tough. People are over-extended. Sometimes desperation can lead us to consider our 401(k) as a savings account that could save the day. Our 401(k) should be the LAST option for cash. Here are five reasons reinforcing why this is a really bad idea, straight from CBS MoneyWatch’s “Evil HR Lady”, Suzanne Luc

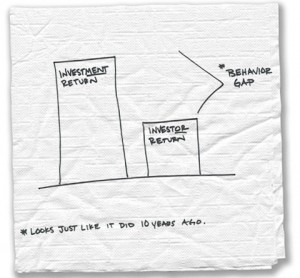

Read MoreAnnual Dalbar Study Shows Investors Are Still Behaving Badly

Dalbar releases an annual study gauging the impact of investor behavior on investors’ long term portfolio returns. Our friend Carl Richards of BehaviorGap.com, writing for the NYTimes.com Bucks blog, illustrates the impact of investors’ decisions on their long term portfolio performance via the findings of this year’s study.

Read More