Posts by Jay Jandasek

(Podcast) 401(k) Participant Advice Best Practices on Talk 401(k) with Don Davidson

I was fortunate enough to be interviewed by Don Davidson of Manarin Investment Counsel for his Talk 401(k) podcast. While Don does an excellent job with this, I cannot say the same for myself. Therefore, if you are willing to overlook my stammerings (I was surprisingly nervous), the information might be helpful to you. Some of the topics included in the conversation include:

What is the difference between advice and guidance?

What is the liability for employers to provide advice to their participants?

The PPA Level Fee requirement

Why advice needs to be ongoing

Advice v. managed accounts

Technology and its impact on participant engagement

It’s Official – We Are Finally BeManaged.com

Here’s a suggestion to businesses…get your business name correct from the get go. Just sayin’. Rebranding is a big job, even for small businesses such as us. That being said, the transition is complete as we have finished the migration to BeManaged.com (we think, anyway). Any links you have bookmarked should still come to our site or the appropriate file. We apologize if you have experienced any confusion or issues over the past few weeks.

Read More5 Reasons NOT to Tap Into Your 401(k)

Times are tough. People are over-extended. Sometimes desperation can lead us to consider our 401(k) as a savings account that could save the day. Our 401(k) should be the LAST option for cash. Here are five reasons reinforcing why this is a really bad idea, straight from CBS MoneyWatch’s “Evil HR Lady”, Suzanne Luc

Read More401(k) Fiduciary Best Practices Available on Your iPod

I am an iPod junkie. I admit it. However, I did not take advantage of the vast library of information available in the Podcast section of iTunes until just lately.

I was recently made aware of Don Davidson’s new “Talk 401k” podcast, and decided to take a listen. After hearing his first podcast with Tom Kmak of Fiduciary Benchmarks, I was sold. The 20 minute interview was concise and informative. I don’t know about you, but when I can listen in and take a break from having to read everything on 401(k) fiduciary best practices, it’s quite nice. I would highly recommend subscribing and listening in when you have a chance.

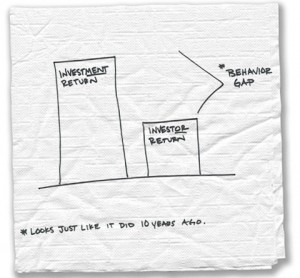

Read MoreAnnual Dalbar Study Shows Investors Are Still Behaving Badly

Dalbar releases an annual study gauging the impact of investor behavior on investors’ long term portfolio returns. Our friend Carl Richards of BehaviorGap.com, writing for the NYTimes.com Bucks blog, illustrates the impact of investors’ decisions on their long term portfolio performance via the findings of this year’s study.

Read More401(k) Investing, Diversification and Asset Allocation – In Plain English

The BeManaged Ingredients and Recipe Investment Analogy

Over the past number of years I have come to really enjoy cooking. It unknowingly led me to an analogy for investing that is simple to understand and better yet, visual. The analogy, consisting of ingredients and the underlying recipe, has helped hundreds of investors better understand what they can ‘control’ within their 401(k). Furthermore it helps investors understand confusing terms such as “diversification” and “asset allocation” and how they impact the ‘behavior’ of their portfolio.

Read MoreA Conversation on 401(k) Advice vs. Guidance – PPA Fiduciary Adviser v. The DoL 96-1 Opinion

When marketing our services to companies sponsoring 401(k) plans, we will often face confusion as to what is truly being offered to participants, guidance or advice. The reason being that the word advice has been used liberally by brokers, advisors, and service providers. Unfortunately, that will sometimes lead to companies assuming their participants are receiving the advice they need, rather than knowing what is actually taking place in those education meetings and any 1on1 interactions that follow. The guidance versus advice being so unclear, that the following is a mock conversation designed to educate plan sponsors and advisors as to what is and isn’t, should and shouldn’t, be taking place with participants so to protect the plan sponsor from fiduciary liability:

Read MoreBeManaged August ’10 Research Newsletter : Capital Disappearing in Private Sector

The following are some highlights discussed in the August ‘10 Research Newsletter from John Whaley, CFA, AIF, Director of the BeManaged Research Department.

Equities Gain Over 7% in July

The EBRI Retirement Readiness Rating

Capital is Disappearing in the Private Sector

5 Tips for the Selection and Monitoring of Your 401(k) Advisor

Jason Roberts, partner at Reish and Reicher, one of the most respected ERISA law firms in the nation, wrote an excellent and concise piece on how to evaluate and monitor the advisor of your plan.

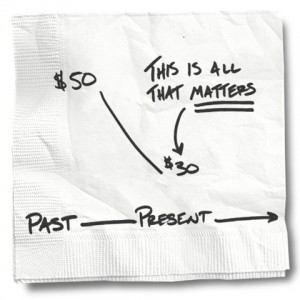

Read MoreEveryone Makes Investing Mistakes, Just Don’t Create ‘Anchors’

Our friend Carl Richards, writing for the NYTimes.com Bucks blog, does an excellent job of speaking to the ‘waiting-until-I-get-back-to-even’ mistake many investors make. It’s called anchoring. Essentially, we create a value in our mind for an investment we want to receive before selling.

Read More