Posts by Jay Jandasek

4 Ways the New 408(b)2 Disclosure Regulations Will Benefit Plan Sponsors

The new 408(b)2 disclosure regs have been long awaited, and present a great opportunity for companies to better understand and benchmark the fees associated with their 401(k) provider. Additionally, it will be require 401(k) service providers to better articulate value in light of the fees they charge. ERISA requires plan fiduciaries to review the fee structure of, and I paraphrase, “reasonable fees for reasonable service.”

Read MoreWhat Was Actium is Now BeManaged (Finally)

Last year, we began the transition of moving from the name Actium to that of our flagship service, BeManaged. For many of you, you may have never noticed that our email was from @myactium.com, while we communicate ourselves as BeManaged. It just didn’t make a lot of sense why our participant clients knew us as BeManaged while companies and advisors knew us as Actium.

Read More401(k) Investors Achilles Heel #4 – Managing Risk Through Contributions

One of the biggest issues we see during this time is people will stop their contributions when the market takes a down turn, and then contribute again once the market is doing “better.” Unfortunately, as with the other achilles heels we have discussed, this is the exact opposite thing 401(k) investors should do.

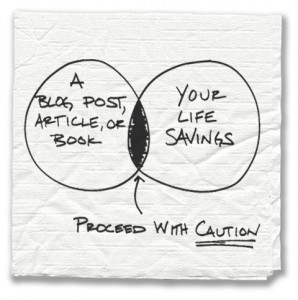

Read MoreIgnore Generic 401(k) Guidance Posed as Advice

We have seen people follow guidance from the likes of the Jim Cramers, Suze Ormans and Dave Ramsey (though we are big fans of his debt reduction advice), which more often than not steers people into an inappropriate portfolio. Many 401(k) providers will even provide some general guidance as well, but they leave investors to figure out the ideal recipe (asset allocation) to create from their plan’s ingredients (investment options).

Read MoreBeManaged Cited in Congressional Testimony Regarding 401(k) Advice

Our friend Matthew Hutcheson, Independent Fiduciary, recently conducted testimony with the Congressional Ways and Means Committee. The goal of the testimony was to discuss the need for fiduciary best practices to continue to be reinforced with 401(k) plan sponsors as well as avoiding the potential conflicts of interest inherent to the broker dealer model.

Read MoreBeManaged July ’10 Market Outlook Newsletter – Second Quarter Ends with a Thud

The following are some highlights discussed in the July ‘10 Research Newsletter from John Whaley, CFA, AIF, Director of the BeManaged Research Department.

Second Quarter Ends with a Thud

Another Review of Long-Term Market Value

A Picture of Risk

BeManaged June ’10 Research Newsletter – Govt. Finance Bubbles Hit World Markets

The following are some of the highlights discussed in the June ‘10 Research Newsletter from John Whaley, CFA, AIF, Director of the BeManaged Research Department.

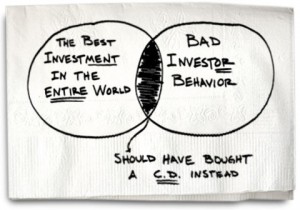

Read MoreAre All Investment Mistakes Investor Mistakes Instead?

Carl Richard’s latest article brings up a very interesting perspective on investing. The following sums is up pretty well,

We’re quick to focus on the reward but fail to appreciate the consequences of our choice. If an investment performs well, we like to think, “I picked a winner.” If it’s the reverse, and the investment fails, it’s someone else’s fault.

Read MoreThoughts on 401(k) Advice Session from fi360 National Conference (Presentation Included)

For the third straight year, I attended the fi360 National Conference, the premier fiduciary-focused conference in the nation. The sessions were outstanding, focusing on the many changes taking place within the retirement plan industry, including those proposed for 401(k) advice. I was fortunate enough to be able to speak on an esteemed panel regarding the topic to a packed house of concerned advisors and retirement plan providers. Here are some key points that were discussed:

Read MoreDoL to Issue New 401(k) Advice Rule Potentially by the Fall

The comment period for the DoL’s new 401(k) advice period ended on March 5th, and the 70 response letters will be under consideration by the Employee Benefits Security Administration. Financial-Planning.com reported that the Department could have the rule on advice finalized as soon as this fall. Though it might end up being four years since the PPA was passed before this rule is finalized, it should be worth the wait for 401(k) investors due to its conflict-free, fiduciary approach.

Read More