Fiduciary Advice & Education Blog

Beware of Confirmation Bias – And its Assault on Your 401k

There is a useful analogy that relates the observation a goldfish makes when looking through the rounded glass of his fish bowl and us – the human. As we might suspect, a goldfish observing the outside world through the lens of a glass bowl would see things differently than you or I. To the goldfish,…

Read MoreAdvisors – An Analogy to Understanding A Fiduciary Vs. A Non-Fiduciary Advisor

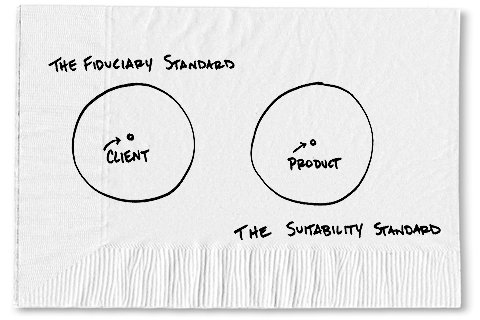

Those who guide individuals on their personal financial decisions generally fall under two categories: those who manage assets acting as a Fiduciary and those who advise clients acting as a Non-Fiduciary. The greatest distinction between these two groups is the incentives behind their guidance. I’ll help clarify what we mean by an analogy. First, the specifics.…

Read MoreVideo – The Difference Between Fiduciaries and Brokers

Over the past few years, I have become a big fan of whiteboard illustrations that simplify concepts which can be challenging to understand. The video below by HighTower Whiteboard Animation does a great job of simplifying the confusion over the difference between brokers and a fiduciary in a nice little analogy. Can’t view? Click here…

Read MoreThe Surprising Paradox of Choice in 401k Plans

You may have heard about experimental studies that aim to capture the human experience when provided a large variety of options. Consumers today are often bombarded with a very high number of choices when they enter shopping malls, department stores, restaurants, mobile phone stores, etc. It is likely we have all experienced a certain level…

Read MoreA Mountain Climber’s Perspective on Risk

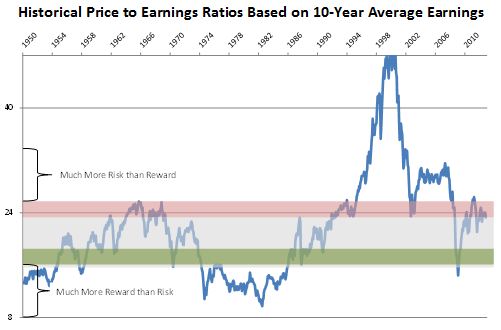

Imagine you’re a mountaineer about to scale the face of El Capitan in Yosemite National Park. As you hike to the bottom of the face your level of risk to injury is relatively low. You might trip and fall on your hike but any injury is nonetheless negligible. In this situation, your exposure to downside…

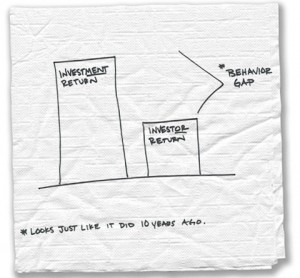

Read More2011 Dalbar Study Finds That Investors are Still Their Own Worst Enemy

Going back to the early 2000’s, our friends at Dalbar have been conducting a study to determine whether investors’ investment decisions impacts their investment performance. Unfortunately, it does. In a BIG way.

Read MoreSurvey Reveals 89% of 401k Investors Want Asset Allocation Help

A survey conducted by the Boston Consulting Group found that investors find retirement planning is confusing and 89% want help creating their ‘investment recipe’ (aka asset allocation). Here are the other findings of the 2,600 investors surveyed:

84% want help calculating and/or creating retirement income

79% would like an annual review “to set and measure their progress”

48% feel they are “in consult of their retirement plan investments”

Coming Soon to 401k Statements: Participants’ Account Balance as Monthly Income?

Fred Reish (he’s getting a lot of attention from us this month) and Bruce Ashton of Drinker Biddle posted an article that discussed having 401k statements illustrate a participant’s account balance in the form of a monthly income. The article is illustrated below and we find this to be an excellent idea, but the following points would need to be considered in order create a consistent message across providers:

Read Morefi360 Webinar Recording: The Combined Effects of the DOL’s Proposed Advice Regulation and 408(b)(2)

CEFEX and fi360 sponsored attorney Fred Reish to provide a thorough overview of the proposed advice and 408(b)(2) regulations. If you are a plan fiduciary who has hired a person or firm to provide your employees advice on their 401k, or an advisor/broker that works with 401k participants, this is essentially a must-listen event. The following were a number of interesting points which affect plan sponsors and advisors:

Read More5 Participant Success Features to Add to Your 401k Plan

Last month, we brought on a new client that was going through a provider change. During our interaction with their employees, we were shocked to find what their old 401k provider DIDN’T offer compared with what their new provider DID. For the sake of full disclosure, we tend to be a little naive in assuming that certain features are a given when it comes to the capabilities of 401k provider websites. That being said, it’s 2011. I can order a burrito from my phone. Thus, if your provider offers any of these functions, the following are some basic online tools (in our naive minds) that we have found participants enjoy, and quite frankly expect in today’s digital age:

Read More