Posts Tagged ‘BeManaged’

Thoughts on 401(k) Advice Session from fi360 National Conference (Presentation Included)

For the third straight year, I attended the fi360 National Conference, the premier fiduciary-focused conference in the nation. The sessions were outstanding, focusing on the many changes taking place within the retirement plan industry, including those proposed for 401(k) advice. I was fortunate enough to be able to speak on an esteemed panel regarding the topic to a packed house of concerned advisors and retirement plan providers. Here are some key points that were discussed:

Read MoreBeManaged Featured in May Edition of Financial Advisor Magazine

In this month’s F-A Magazine, BeManaged was featured in the article titled “Better Laid Plans,” which is focused on how companies around the nation are answering the call for 401(k) advice. It was a privilege to be included in the article, but there is a key point we would like to correct about how we operate.

We do NOT control the investor’s contributions. The participant is ALWAYS in complete control, we simply provide encouragement and strategies for how to increase those contributions.

Read MoreBeManaged Co-Founder Presenting at ’10 fi360 National Conference

As in ’09, I will be presenting with a distinguished panel of speakers on the timely topic of 401(k) advice at the ’10 fi360 National Conference. The session, titled “401(k) Participant Advice: How to Protect Plan Sponsors and Yourself.”

Read MoreBeManaged April ’10 Newsletter – Stocks Accelerate and the Use of Bonds/Money Markets in Your 401(k)

The following are some of the topics discussed in this month’s newsletter from John Whaley, CFA, AIF, the Director of our Research Department.

Stock Gains Accelerate in March

Trends in Savings and Investments Among Workers

Use of Stable Value/Money Market Funds and Bond Funds in Your Retirement Portfolio

New on LinkedIn: The 401(k) Fiduciary Advice Group

LinkedIn has been something I have been active on for over two years. It’s Groups feature has helped it evolve into a resource in which busy professionals can learn or get free guidance and feedback on various topics of interest. Personally, our company has benefited from other’s experience and expertise to the tune of saving thousands of dollars on various projects.

That being said, with the recent developments in 401(k) advice, we decided to create a group to help keep employers and advisors apprised of the regulatory and market developments that result from the clarifications. We launched the 401(k) Fiduciary Advice Group on Wednesday morning, and since then, there have been over 70 employers and 401(k) industry professionals join. Interested? Simply click the link below to join.

Read MoreBeManaged March ’10 Newsletter – The Advancing US Dollar and Your 401(k)

The following are some of the topics discussed in this month’s newsletter from John Whaley, CFA, AIF, the Director of our Research Department.

Advancing US Dollar Translates to Declining Foreign Stock Returns

Mutual Fund Fees and the Impact on Your Acccount

How Does Your 401(k) Account Growth Compare?

New 401(k) Advice Proposal Available for Comments Until May 5th

As promised, the new 401(k) advice proposal has been delivered before the end of the month. While I admit to not having read it in its entirety, the following has been reported by the Wall Street Journal:

Read MoreStudies Show the Less You Do With Your 401(k), the More You Earn

ometimes, it helps to hear this from an independent source…

Don’t take this too personally, but the less you are involved with investment decisions for your 401(k) the better off you may be.

Sometimes, it helps to hear this type of thing from an independent source. As we have said before, we don’t fix our own cars, why should we be expected to be professional investment managers?

Don’t take this too personally, but the less you are involved with investment decisions for your 401(k) the better off you may be.

A new study of more than 400,000 401(k) participants in seven corporate plans found that the median return earned by individuals who sought out help in managing their 401(k) was 1.86 percentage points more than participants who made their own allocation/investment decisions.

Read MoreA Model for 401(k) Advice, Pt. 1 – Must be Conflict-Free

Many 401(k) sponsors, providers and advisors eagerly await the DoL’s new advice proposal, which is due to be released within the next 30-45 days. In an effort to put in our two cents, we thought we would share our hopes for the proposal based on our experience in delivering advice, our understanding of other options in the marketplace, and the feedback we have received from employers and investors alike. Keep in mind most of our clients exist in the top end of the small market (250+ employees) to large sized employers (1,000+ employees).

Goal #1 – Advice Must be 100% Conflict-Free

We believe advice for 401(k) investors must be start with being conflict-free. If there are conflicts in providing participants advice, then 401(k) advice is doomed to fail. So, let’s look at how to ensure this holds true for participants and the employers that are required to do their due diligence on service providers, including advice providers.

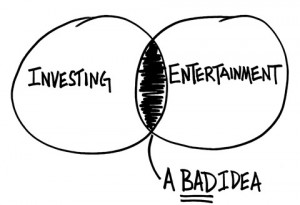

Investing Is Not Entertainment

As you know, we are big fans of the BehaviorGap. Our friend Carl Richards is now being featured in the New York Times website. His latest post there is two minutes of really good advice.

Am I investing to meet my most important financial goals or am I investing as a form of entertainment? For almost all of us, it can’t be both.