Posts Tagged ‘retirement’

Getting a Tax Refund? Be Like the 50% of People Using it Wisely

Tax day is only a few weeks away. If you are receiving a tax refund, you have some fun decisions to make. A recent study found that only 31% plan to put some of the refund toward their retirement savings, and another 19% plan to pay down debt…meaning only half of people are taking steps to improve their financial situation with their refund.

We know. You get a check in the mail or it shows up in your checking/savings account. Saving it or paying down debt is about as fun and exciting as…well…I don’t know, but it’s not. Unfortunately, doing the right thing sometimes isn’t that fun. However, it is a good feeling when you do the right thing.

Read More5 Participant Success Features to Add to Your 401k Plan

Last month, we brought on a new client that was going through a provider change. During our interaction with their employees, we were shocked to find what their old 401k provider DIDN’T offer compared with what their new provider DID. For the sake of full disclosure, we tend to be a little naive in assuming that certain features are a given when it comes to the capabilities of 401k provider websites. That being said, it’s 2011. I can order a burrito from my phone. Thus, if your provider offers any of these functions, the following are some basic online tools (in our naive minds) that we have found participants enjoy, and quite frankly expect in today’s digital age:

Read MoreBeManaged March Newsletter – February Good for Small Cap Stocks

The following are some topics covered in this month’s Research Newsletter from the BeManaged Research Department.

Sales and Earnings Gains Projected to Continue in 2011

Small Cap Stocks Big Winners in February

Investment Returns and Overall Account Growth

BeManaged January Newsletter – 2010 Review and Look Forward at 2011

The following are some topics covered in this month’s Research Newsletter from the BeManaged Research Department.

Asset Price Inflation Wins in 2010

2010 Market Returns Positive Across the Board

The State of Corporate Balance Sheets

Government Debt and Deficits

Don’t Get Burned – Put More Focus on the Recipe Than the Ingredients

A few months ago, I made a big pot of chili. I have made my Mom’s recipe my own, and always enjoy how it turns out. However, I incorporated a few new ingredients that time, and the initial result was quite interesting. I discovered an important lesson – I have some learning to do when cooking with cayenne pepper. When I checked it after it had been cooking for a couple of hours, I found it to look and smell like chili. After tasting it however, it was so spicy that I thought it was molten lava going down my throat.

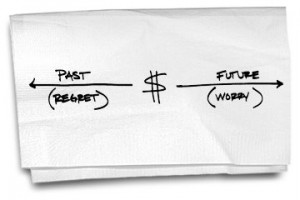

Read More5 Tips to Help Stop Worrying About Money

The following article by Carl Richards at the NYTimes.com made some really good points regarding our propensity to beat ourselves up over past mistakes as well as worrying about the future with respect to money. I have been guilty of this, so this really hit home for me. Simply put, we are all human and make mistakes in many aspects of our lives, including financial decisions.

Read MoreBeManaged December Market Research Newsletter – Domestic Stocks Flat in November

The following are some topics covered in this month’s Research Newsletter from the BeManaged Research Department.

Domestic Stocks Flat in November

Is It Possible They are Going Too Fast?

Estimating Your Retirement Income Adequacy

BeManaged November Market Research Newsletter – What’s Another $600,000,000,000?

The following are some topics covered in this month’s Research Newsletter from John Whaley, CFA, AIF, Director of the BeManaged Research Department.

What’s Another $600,000,000,000 Among Friends?

Good News for Dividend Collectors

Consumers Continue to Lack Confidence

2011 IRS Contributions Limits for Your 401k/403b

Last week, the IRS released the contribution limits for 401k/403b investors, and the amounts remain unchanged for 2011. Here are the numbers:

Elective Deferral (traditional limits) – $16,500

Catch-up Contribution for Investors 50 yrs and Older – $5,500

The reality is, your contributions to your 401k/403b is the #1 reason for your success as an investor. Here are some strategies for increasing your contributions:

BeManaged October Research Newsletter – Asset Class Correlations and Your Portfolio

The following are some topics covered in this month’s Research Newsletter from John Whaley, CFA, AIF, Director of the BeManaged Research Department.

Third Quarter Ends on Positive Note

Pension Plans Continue Rosy Expectations

Asset Class Correlations and Your Portfolio