Posts Tagged ‘retirement’

Market Forecasts, a.k.a. Market Guesses

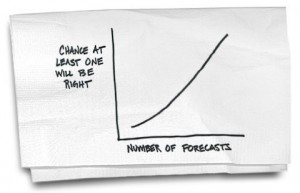

Soothsayer. Prognosticator. The illusory crystal ball. The market forecasts that are lauded by the media…whose goal is to sell advertising…are simply speculation. We have told investors since day one that no one truly knows what the market is going to do by the end of the week, month or year. If you meet someone that claims they do…run…in the oppositive direction. Fast.

Read More3 Ways to Spot a Bad Investor (Video)

CBS Marketwatch.com just put out a handy little video to help identify whether you, your friend or your advisor is a bad investor. It’s brief, and definitely true.

Read More5 Reasons NOT to Tap Into Your 401(k)

Times are tough. People are over-extended. Sometimes desperation can lead us to consider our 401(k) as a savings account that could save the day. Our 401(k) should be the LAST option for cash. Here are five reasons reinforcing why this is a really bad idea, straight from CBS MoneyWatch’s “Evil HR Lady”, Suzanne Luc

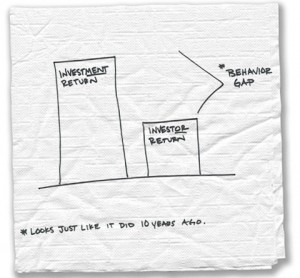

Read MoreAnnual Dalbar Study Shows Investors Are Still Behaving Badly

Dalbar releases an annual study gauging the impact of investor behavior on investors’ long term portfolio returns. Our friend Carl Richards of BehaviorGap.com, writing for the NYTimes.com Bucks blog, illustrates the impact of investors’ decisions on their long term portfolio performance via the findings of this year’s study.

Read More401(k) Investing, Diversification and Asset Allocation – In Plain English

The BeManaged Ingredients and Recipe Investment Analogy

Over the past number of years I have come to really enjoy cooking. It unknowingly led me to an analogy for investing that is simple to understand and better yet, visual. The analogy, consisting of ingredients and the underlying recipe, has helped hundreds of investors better understand what they can ‘control’ within their 401(k). Furthermore it helps investors understand confusing terms such as “diversification” and “asset allocation” and how they impact the ‘behavior’ of their portfolio.

Read MoreBeManaged August ’10 Research Newsletter : Capital Disappearing in Private Sector

The following are some highlights discussed in the August ‘10 Research Newsletter from John Whaley, CFA, AIF, Director of the BeManaged Research Department.

Equities Gain Over 7% in July

The EBRI Retirement Readiness Rating

Capital is Disappearing in the Private Sector

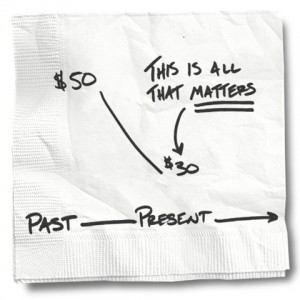

Everyone Makes Investing Mistakes, Just Don’t Create ‘Anchors’

Our friend Carl Richards, writing for the NYTimes.com Bucks blog, does an excellent job of speaking to the ‘waiting-until-I-get-back-to-even’ mistake many investors make. It’s called anchoring. Essentially, we create a value in our mind for an investment we want to receive before selling.

Read More401(k) Investors Achilles Heel #4 – Managing Risk Through Contributions

One of the biggest issues we see during this time is people will stop their contributions when the market takes a down turn, and then contribute again once the market is doing “better.” Unfortunately, as with the other achilles heels we have discussed, this is the exact opposite thing 401(k) investors should do.

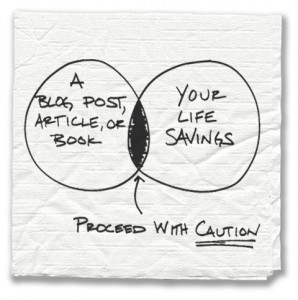

Read MoreIgnore Generic 401(k) Guidance Posed as Advice

We have seen people follow guidance from the likes of the Jim Cramers, Suze Ormans and Dave Ramsey (though we are big fans of his debt reduction advice), which more often than not steers people into an inappropriate portfolio. Many 401(k) providers will even provide some general guidance as well, but they leave investors to figure out the ideal recipe (asset allocation) to create from their plan’s ingredients (investment options).

Read MoreBeManaged July ’10 Market Outlook Newsletter – Second Quarter Ends with a Thud

The following are some highlights discussed in the July ‘10 Research Newsletter from John Whaley, CFA, AIF, Director of the BeManaged Research Department.

Second Quarter Ends with a Thud

Another Review of Long-Term Market Value

A Picture of Risk