Posts Tagged ‘retirement’

BeManaged June ’10 Research Newsletter – Govt. Finance Bubbles Hit World Markets

The following are some of the highlights discussed in the June ‘10 Research Newsletter from John Whaley, CFA, AIF, Director of the BeManaged Research Department.

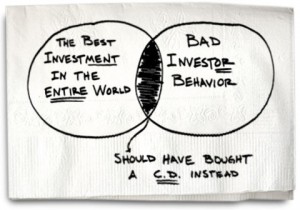

Read MoreAre All Investment Mistakes Investor Mistakes Instead?

Carl Richard’s latest article brings up a very interesting perspective on investing. The following sums is up pretty well,

We’re quick to focus on the reward but fail to appreciate the consequences of our choice. If an investment performs well, we like to think, “I picked a winner.” If it’s the reverse, and the investment fails, it’s someone else’s fault.

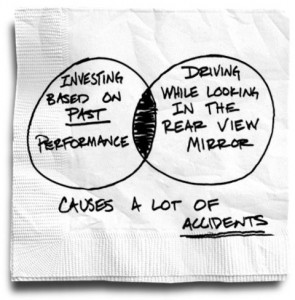

Read MoreThe Temptation (and Danger) of Past Investment Performance – NYTimes Bucks Blog

It’s understandable. You are looking to invest in something different in your 401(k), and what is the most accessible bogey to judge the funds in your plan? Past performance. It tugs at the foundation of human nature, greed and fear.

Read MoreBeManaged May ’10 Research Newsletter – Red Flags that Deserve Attention

The following are some of the highlights discussed in the May ’10 Research Newsletter from John Whaley, CFA, AIF, Director of the BeManaged Research Department.

Read MoreConsidering a Roth Conversion? Avoid the Crooks

When we hear about 401(k) investors moving all or a portion of their account to an IRA, the question becomes, “What did they invest you in?” Now, with the new tax law that enables investors to more easily convert their traditional IRA assets to a Roth IRA, brokers, insurance agents, and other financial product salespeople…

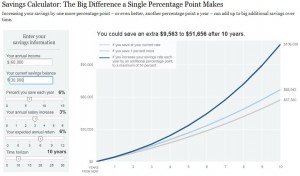

Read More401(k) Investors’ Achilles Heel #3: Expecting Investment Performance to do All of the Work

I have to give it to the NYTimes. Their new “Bucks” blog includes great insight from our friend Carl Richards of BehaviorGap.com. Just yesterday they posted a very easy to use, interactive 401(k) savings calculator that illustrates how increasing your contributions just 1% creates a very different retirement picture for you upon retirement, while avoiding…

Read MoreBeManaged April ’10 Newsletter – Stocks Accelerate and the Use of Bonds/Money Markets in Your 401(k)

The following are some of the topics discussed in this month’s newsletter from John Whaley, CFA, AIF, the Director of our Research Department.

Stock Gains Accelerate in March

Trends in Savings and Investments Among Workers

Use of Stable Value/Money Market Funds and Bond Funds in Your Retirement Portfolio

A Model for 401(k) Advice, Pt. 2 – Must be Ongoing

A fiduciary relationship is one which is ongoing, in which the fiduciary is responsible for conducting ongoing due diligence on the various provisions for which they are responsible. A company fiduciary is charged with the responsibility of ongoing due diligence of the various fees, investment options, and vendor capabilities of the plan for the benefit of the participants. An ERISA fiduciary, regardless of the “flavor,” is hired to provide ongoing advice to the employer specific to investment due diligence and advice, vendor benchmarking, etc. Both of these more traditional fiduciary roles are ongoing relationships. Why isn’t employee fiduciary advice?

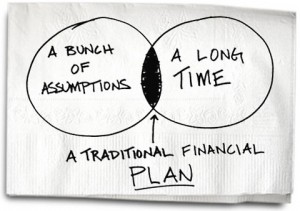

Read More401(k) Investors’ Achilles Heel #2: Goal-Based Investing – Good or Bad?

This month, our team has conducted dozens of 1-on-1 consultations. During these consultations, we walk the 401(k) investor through an investor questionnaire that takes into account their age, time horizon for accessing their 401(k) assets, and their risk tolerance. During this review of their account, we consistently run into investors who have an expectation of what they need to achieve from a performance standpoint in order to meet their goals. Just as I was considering this, Carl Richards wrote an article (click the napkin to read) specific to whether financial plans are worth the paper they are drawn up on.

Read More401(k) Investor Achilles Heel #1: Overconfidence

From time to time, all of us think we know what we are doing when clearly we do not, but it is not until we are proven wrong that we come to realize it. For me, it’s home repair. I know it’s not my strong suit, but my “man” button keeps blinding me to that fact until I am calling the repairman to fix the original problem and everything additional that I destroyed, broke, etc.

That, my friends, is humility. And humility is good for all of us. When it comes to investing, such overconfidence in our abilities can be extremely costly. In fact, the larger the balance of your 401(k), the more costly mistakes can be to you.

Read More