Posts by Jay Jandasek

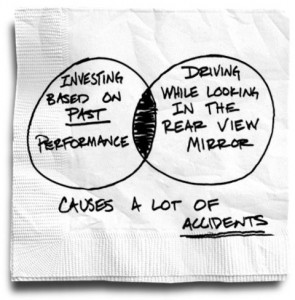

The Temptation (and Danger) of Past Investment Performance – NYTimes Bucks Blog

It’s understandable. You are looking to invest in something different in your 401(k), and what is the most accessible bogey to judge the funds in your plan? Past performance. It tugs at the foundation of human nature, greed and fear.

Read MoreBeManaged Featured in May Edition of Financial Advisor Magazine

In this month’s F-A Magazine, BeManaged was featured in the article titled “Better Laid Plans,” which is focused on how companies around the nation are answering the call for 401(k) advice. It was a privilege to be included in the article, but there is a key point we would like to correct about how we operate.

We do NOT control the investor’s contributions. The participant is ALWAYS in complete control, we simply provide encouragement and strategies for how to increase those contributions.

Read MoreBeManaged May ’10 Research Newsletter – Red Flags that Deserve Attention

The following are some of the highlights discussed in the May ’10 Research Newsletter from John Whaley, CFA, AIF, Director of the BeManaged Research Department.

Read MorePoll: More or Less 401(k) Advice?

Weigh in with your vote regarding the affect the DoL’s 401(k) advice proposal will have on the accessibility of advice for investors on LinkedIn. More? Less? No Change?

Read MoreBeManaged Co-Founder Presenting at ’10 fi360 National Conference

As in ’09, I will be presenting with a distinguished panel of speakers on the timely topic of 401(k) advice at the ’10 fi360 National Conference. The session, titled “401(k) Participant Advice: How to Protect Plan Sponsors and Yourself.”

Read MoreConsidering a Roth Conversion? Avoid the Crooks

When we hear about 401(k) investors moving all or a portion of their account to an IRA, the question becomes, “What did they invest you in?” Now, with the new tax law that enables investors to more easily convert their traditional IRA assets to a Roth IRA, brokers, insurance agents, and other financial product salespeople…

Read More401(k) Paternalism – Employers Take More Active Role in Employees’ 401(k) Decisions

This month’s CFO magazine featured an interesting article regarding the change taking place in how employers’ are taking a more paternalistic approach to their employees’ decisions with their 401(k) accounts. Some of the issues that have made paternalism more necessary (not that it’s new news) are as follows:

Read More401(k) Managed Accounts – Simply a Method of Delivering 401(k) Advice

401(k) managed accounts and 401(k) advice are often considered two entirely different things in the retirement plan industry. Apples and oranges? I find this odd, to put it lightly. The ’01 SunAmerica Opinion opened the door for participants to receive advice or account management on a fee for service basis. Specifically, the following is the text from the SunAmerica Opinion, which simply states both investment advice and “discretionary asset allocation” (aka account management/managed accounts) are available:

Read MoreWhat Are Your Questions Regarding the New 401(k) Advice Proposal?

Since the DoL’s new 401(k) advice regulations were submitted on February 26th, what are your biggest questions? The most commonly discussed questions have included the following:

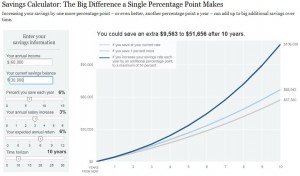

Read More401(k) Investors’ Achilles Heel #3: Expecting Investment Performance to do All of the Work

I have to give it to the NYTimes. Their new “Bucks” blog includes great insight from our friend Carl Richards of BehaviorGap.com. Just yesterday they posted a very easy to use, interactive 401(k) savings calculator that illustrates how increasing your contributions just 1% creates a very different retirement picture for you upon retirement, while avoiding…

Read More