Participant Outcomes

How to Review the Performance of your Investments

Your investment statements are arriving, so many of us will take a look at our investment accounts to see how we (or our advisor) did. Unfortunately, it can be a bit confusing to determine if we did well, average or poorly. Let’s look at the items that will help you determine how you did. How…

Read MoreDraper, Inc. Wins 2014 PlanSponsor of the Year by PlanSponsor Magazine

BeManaged is honored to be the advice provider for the Draper, Inc. retirement plan, which won the 2014 PlanSponsor of the Year for plans <$50MM. Draper’s diligence and commitment to the success of their participants is impressive and it is great to see them recognized for their efforts. We would like to note that utilization…

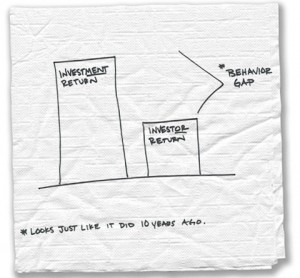

Read More2011 Dalbar Study Finds That Investors are Still Their Own Worst Enemy

Going back to the early 2000’s, our friends at Dalbar have been conducting a study to determine whether investors’ investment decisions impacts their investment performance. Unfortunately, it does. In a BIG way.

Read MoreSurvey Reveals 89% of 401k Investors Want Asset Allocation Help

A survey conducted by the Boston Consulting Group found that investors find retirement planning is confusing and 89% want help creating their ‘investment recipe’ (aka asset allocation). Here are the other findings of the 2,600 investors surveyed:

84% want help calculating and/or creating retirement income

79% would like an annual review “to set and measure their progress”

48% feel they are “in consult of their retirement plan investments”

Survey Demonstrates Better Results for 401k Participants Using Advice

A recent study illustrated finds that 401k participants using advice are better diversified and have larger balances. Here are some interesting findings of the survey:

Improved Diversification – Participants held 74% more funds in their portfolio (8.67 versus 4.98 funds)

Improved Performance – 3 Year Annualized Return was 2.67% better than do-it-yourself investors

Larger Balances Seek Advice – Average balance of participants using advice was $107,558 versus $44,178 of do-it-yourself investors

These results are very similar to our experience with 401k investors. We find that participants using advice (or managed accounts) are better diversified and experience better downside protection due to improved risk management. Additionally, the larger the balance, the more likely the participant is to seek advice.

A User’s Guide for 401(k) Education v. Advice – What Fits Your Participants?

Improving the ‘participant experience’ is taking shape. The biggest question becomes, “What will work best with our participants, and how is it best delivered so it is not something we will have to ‘re-do’ in the future?”

Read More401(k) Investing, Diversification and Asset Allocation – In Plain English

The BeManaged Ingredients and Recipe Investment Analogy

Over the past number of years I have come to really enjoy cooking. It unknowingly led me to an analogy for investing that is simple to understand and better yet, visual. The analogy, consisting of ingredients and the underlying recipe, has helped hundreds of investors better understand what they can ‘control’ within their 401(k). Furthermore it helps investors understand confusing terms such as “diversification” and “asset allocation” and how they impact the ‘behavior’ of their portfolio.

Read MoreThoughts on 401(k) Advice Session from fi360 National Conference (Presentation Included)

For the third straight year, I attended the fi360 National Conference, the premier fiduciary-focused conference in the nation. The sessions were outstanding, focusing on the many changes taking place within the retirement plan industry, including those proposed for 401(k) advice. I was fortunate enough to be able to speak on an esteemed panel regarding the topic to a packed house of concerned advisors and retirement plan providers. Here are some key points that were discussed:

Read More401(k) Paternalism – Employers Take More Active Role in Employees’ 401(k) Decisions

This month’s CFO magazine featured an interesting article regarding the change taking place in how employers’ are taking a more paternalistic approach to their employees’ decisions with their 401(k) accounts. Some of the issues that have made paternalism more necessary (not that it’s new news) are as follows:

Read More401(k) Managed Accounts – Simply a Method of Delivering 401(k) Advice

401(k) managed accounts and 401(k) advice are often considered two entirely different things in the retirement plan industry. Apples and oranges? I find this odd, to put it lightly. The ’01 SunAmerica Opinion opened the door for participants to receive advice or account management on a fee for service basis. Specifically, the following is the text from the SunAmerica Opinion, which simply states both investment advice and “discretionary asset allocation” (aka account management/managed accounts) are available:

Read More