Posts Tagged ‘401k tips’

Beware of Confirmation Bias – And its Assault on Your 401k

There is a useful analogy that relates the observation a goldfish makes when looking through the rounded glass of his fish bowl and us – the human. As we might suspect, a goldfish observing the outside world through the lens of a glass bowl would see things differently than you or I. To the goldfish,…

Read MoreApril Newsletter: An Exceptional Quarter and the Monetary Base

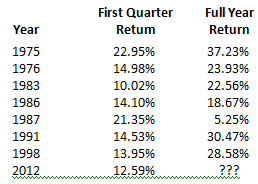

Headlines Tout Largest First Quarter Gains in Years! What Happens Next? How can we not be excited! The S&P 500 rose 12.6% over the first three months of this year, the best start since 1998. Foreign stocks rode along, with an 11% gain since December 31st. Over the last 40 years, the record hints that…

Read MoreVideo – The Difference Between Fiduciaries and Brokers

Over the past few years, I have become a big fan of whiteboard illustrations that simplify concepts which can be challenging to understand. The video below by HighTower Whiteboard Animation does a great job of simplifying the confusion over the difference between brokers and a fiduciary in a nice little analogy. Can’t view? Click here…

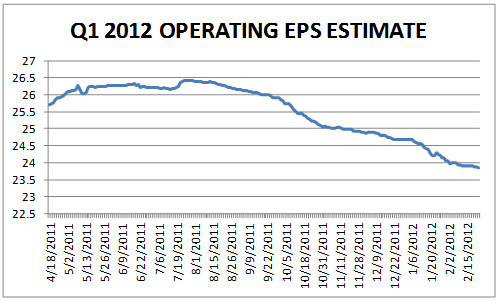

Read MoreMarch Newsletter – Earnings Estimates Dropping

February Market Returns Good news for aggressive investors Aggressive investors were rewarded in the month of February with the Dow Jones Aggressive benchmark returning 4.63% on investor capital. The S&P 500 index, the broadest and most comprehensive measure of U.S. equities, returned 4.32%. International investors did equally a well with the Morgan Stanley Capital International…

Read MoreFebruary Newsletter – Considering Risk When Evaluating Your Investment Options

Adding Measures of Risk to Your Fund Evaluation Picking your funds based solely on performance is a common mistake Return numbers are the most readily accessible pieces of information available to you as an investor. As a result, it is too easy to make fund choices for your 401(k) based on those returns. The level…

Read MoreThe Surprising Paradox of Choice in 401k Plans

You may have heard about experimental studies that aim to capture the human experience when provided a large variety of options. Consumers today are often bombarded with a very high number of choices when they enter shopping malls, department stores, restaurants, mobile phone stores, etc. It is likely we have all experienced a certain level…

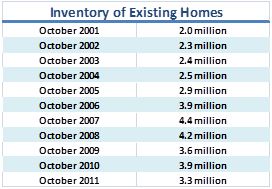

Read MoreBeManaged Year End Newsletter – 2011 Was a Treacherous Ride to Nowhere

Conservative Investors Rewarded in 2011 A treacherous ride to nowhere Pretend for a moment you pulled off your best Rip Van Winkle imitation and slept through 2011. You pick up a “Year in Review” newspaper, and find out: A number of European countries (Portugal, Italy, Greece, Spain) are close to defaulting on their debt. The…

Read MoreBeManaged December Newsletter – Unemployment Rate Voodoo and Retirees’ Financial Health

Unemployment Rate Voodoo Producers Continue to Leave the Labor Force The announcement of a decline in the nation’s unemployment rate from 9.0% to 8.6% was treated gleefully in news headlines. Unfortunately, there is more to the story. Over the past 60+ years, the number of people who are participating in the labor force grows an…

Read MoreBeManaged November Newsletter – The European Debacle Continues

The European Debacle Continues “It’s tough to make predictions, especially about the future” – Mark Twain The European saga continues! In the final weeks of October, the European Union constructed a bailout package to save Greece from almost certain default. Markets around the world cheered the news as a sign of hope for the debt…

Read More7 Lies We Tell Ourselves About Saving Money (Video)

Recently, I have had some interesting conversations that centered around how we talk ourselves out of saving money. Simply put, we tell ourselves little lies we make up in our head. We end up talking about how we spend money, as if we manage that, saving it is easy. Let’s face it, it’s much more…

Read More