Posts Tagged ‘investment behavior’

Survey Demonstrates Better Results for 401k Participants Using Advice

A recent study illustrated finds that 401k participants using advice are better diversified and have larger balances. Here are some interesting findings of the survey:

Improved Diversification – Participants held 74% more funds in their portfolio (8.67 versus 4.98 funds)

Improved Performance – 3 Year Annualized Return was 2.67% better than do-it-yourself investors

Larger Balances Seek Advice – Average balance of participants using advice was $107,558 versus $44,178 of do-it-yourself investors

These results are very similar to our experience with 401k investors. We find that participants using advice (or managed accounts) are better diversified and experience better downside protection due to improved risk management. Additionally, the larger the balance, the more likely the participant is to seek advice.

7 Steps to Keep from Getting Carried Away by the Market Rally

The Wall Street Journal recently wrote a very good article on keeping your expectations in check in light of the market rally that took place during the second half of 2010. The following are seven points to consider in as you make decisions on your portfolio:

Read MoreBeManaged January Newsletter – 2010 Review and Look Forward at 2011

The following are some topics covered in this month’s Research Newsletter from the BeManaged Research Department.

Asset Price Inflation Wins in 2010

2010 Market Returns Positive Across the Board

The State of Corporate Balance Sheets

Government Debt and Deficits

Don’t Get Burned – Put More Focus on the Recipe Than the Ingredients

A few months ago, I made a big pot of chili. I have made my Mom’s recipe my own, and always enjoy how it turns out. However, I incorporated a few new ingredients that time, and the initial result was quite interesting. I discovered an important lesson – I have some learning to do when cooking with cayenne pepper. When I checked it after it had been cooking for a couple of hours, I found it to look and smell like chili. After tasting it however, it was so spicy that I thought it was molten lava going down my throat.

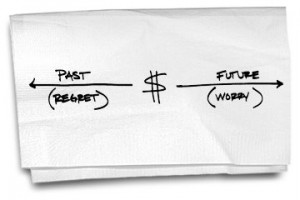

Read More5 Tips to Help Stop Worrying About Money

The following article by Carl Richards at the NYTimes.com made some really good points regarding our propensity to beat ourselves up over past mistakes as well as worrying about the future with respect to money. I have been guilty of this, so this really hit home for me. Simply put, we are all human and make mistakes in many aspects of our lives, including financial decisions.

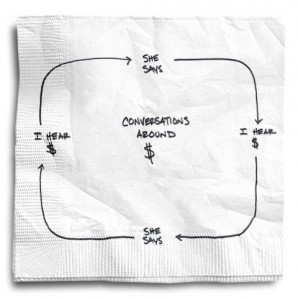

Read MoreConversations About Money…Even When They Are Not

If you follow this blog at all, you know I am a fan of Carl Richards, who does a fantastic job of simplifying investing concepts but also our behaviors around money. The following post from the New York Times is a fantastic example and advice from which we can all (mostly us men) can benefit from.

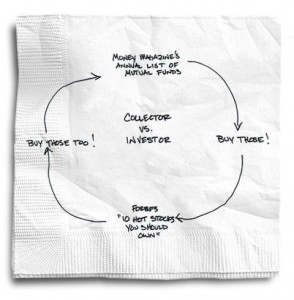

Read MoreAre You an Investor or a Collector?

Our friend Carl Richards of BehaviorGap.com and the NYTimes.com Bucks blog has done a great job of illustrating how the ‘over diversification’ of portfolios can simply be ‘buying more’ instead of ‘buying different.’

Over- or under-diversifying your investments remains one of the classic behavioral mistakes.

Over-diversification happens when we become collectors of investments instead of simply being investors. Think of the people who buy the mutual funds they read about in Smart Money magazine. Next year they buy the Top 10 Funds recommended by Money magazine. A year later they buy two or three new international funds because that’s what’s on the home page of Forbes.

Read More2011 IRS Contributions Limits for Your 401k/403b

Last week, the IRS released the contribution limits for 401k/403b investors, and the amounts remain unchanged for 2011. Here are the numbers:

Elective Deferral (traditional limits) – $16,500

Catch-up Contribution for Investors 50 yrs and Older – $5,500

The reality is, your contributions to your 401k/403b is the #1 reason for your success as an investor. Here are some strategies for increasing your contributions:

A User’s Guide for 401(k) Education v. Advice – What Fits Your Participants?

Improving the ‘participant experience’ is taking shape. The biggest question becomes, “What will work best with our participants, and how is it best delivered so it is not something we will have to ‘re-do’ in the future?”

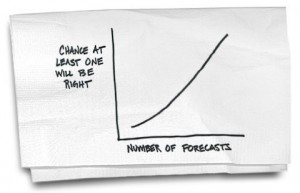

Read MoreMarket Forecasts, a.k.a. Market Guesses

Soothsayer. Prognosticator. The illusory crystal ball. The market forecasts that are lauded by the media…whose goal is to sell advertising…are simply speculation. We have told investors since day one that no one truly knows what the market is going to do by the end of the week, month or year. If you meet someone that claims they do…run…in the oppositive direction. Fast.

Read More