Posts Tagged ‘BeManaged Newsletter’

November Newsletter – Recession in the Works for 2013?

Recession in the Works for 2013? St. Louis Fed indicator may be clue – But what happens to our investments? Information for this article comes from Lance Roberts, www.streettalklive.com, November 6th, 2012, and data from www.stlouisfed.org. Investment professionals are raising red flags over a U.S. Recession Probabilities Index measure available at the St. Louis Federal…

Read MoreOctober Newsletter – 2012: A Profitable Year or is There Trouble Around the Corner?

Will the Fourth Quarter Finish off a Profitable Investment Year? – Or is Trouble Around the Corner? Four straight months of positive returns for the S&P 500 have elevated stock prices to near-peak levels for 2012. Large cap stocks in the United Stated gained 2.6% last month, and smaller companies gained over 3%. A five…

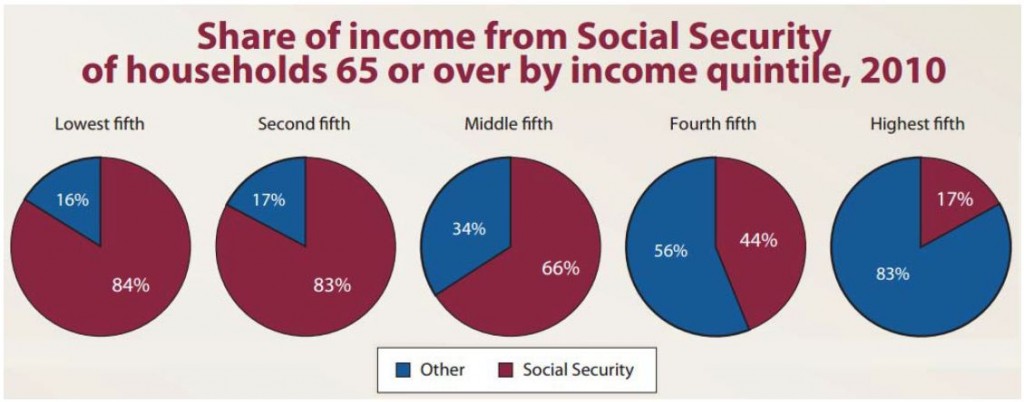

Read MoreSeptember Newsletter – Declines in Median Household Income and the Long-Term Impact on Investment Returns

Three Month Rally Moves Domestic Stock Returns to Double-digits for 2012 The 2% gain in the S&P 500 in August pushed the returns for large cap funds above the 10% mark for 2012. Foreign stock funds continue to lag, returning less than 7%. Surprisingly, bond funds continue to do well in an environment where interest…

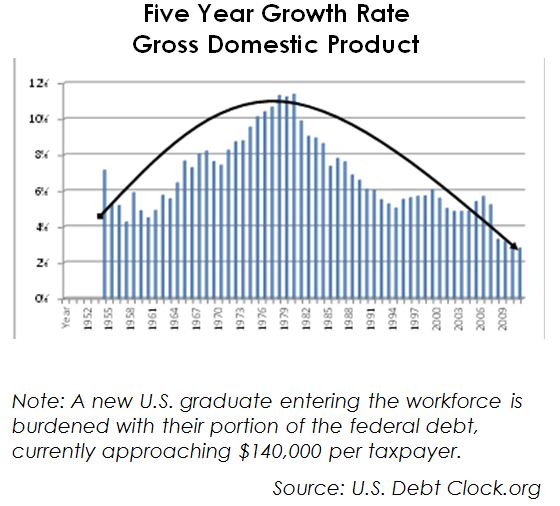

Read MoreAugust Newsletter – Is Government Stimulus Really an Economic Stimulus?

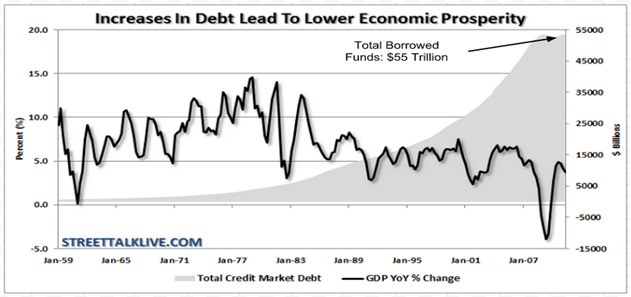

What Does Brittany Wenger Have to Do With My Retirement Portfolio? Will continued insistence on borrowing from the capital of future generations lead to a long period of decline? Brittany Wenger is a 17-year-old South Florida resident entering her senior year of high school. Brittany wrote a computer program utilizing artificial intelligence technology to detect…

Read MoreJuly Newsletter – Will More Risk Ever Mean More Reward?

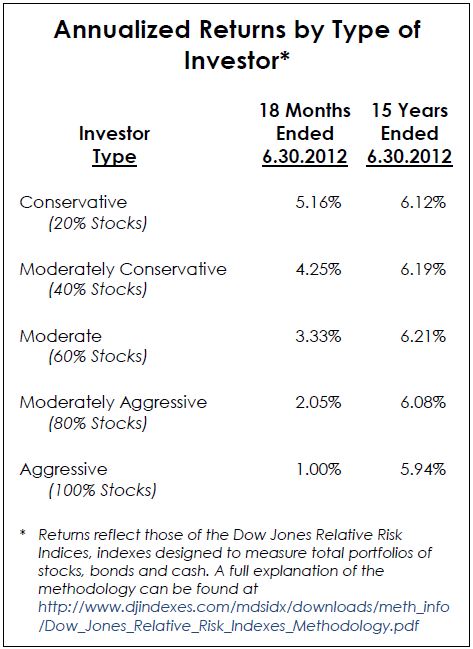

Will More Risk Ever Translate Into More Return? The last Eighteen Months looks the same as the last Fifteen Years Let’s review of the dogmas of the investing world: Over the long run, stocks ALWAYS outperform bonds; The more aggressive you are as an investor, the more you will be rewarded with higher long term…

Read MoreJune Newsletter – U.S. Treasury Yields Hit Historic Lows

U.S. Treasury Yields Hit Historic Lows Bond Markets Flooded with Treasury Securities; Something Has to Give? The benchmark 10 year treasury yield fell below 1.5 % on the morning of June 1st. According to Reuters, interest rates like this have not been seen since the early 1800’s – and as the saying goes: an unusual…

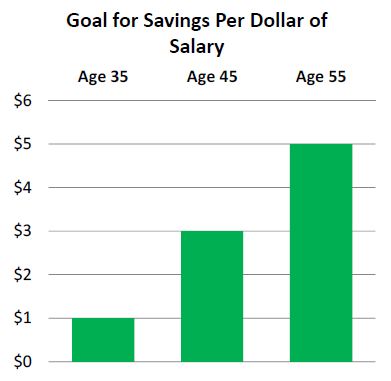

Read MoreMay Newsletter – Fiscal Debt and Investment Returns

Investment Returns and Overall Account Growth Your contribution level critical to a successful retirement The Employee Benefit Research Institute’s latest survey of 401(k) valuations looks at account growth by age and tenure (number of years participating in the plan). From January 1, 2011 through January 31, 2012, account values of newcomers under the age of…

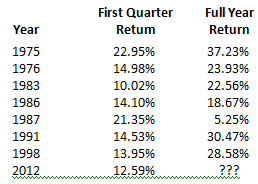

Read MoreApril Newsletter: An Exceptional Quarter and the Monetary Base

Headlines Tout Largest First Quarter Gains in Years! What Happens Next? How can we not be excited! The S&P 500 rose 12.6% over the first three months of this year, the best start since 1998. Foreign stocks rode along, with an 11% gain since December 31st. Over the last 40 years, the record hints that…

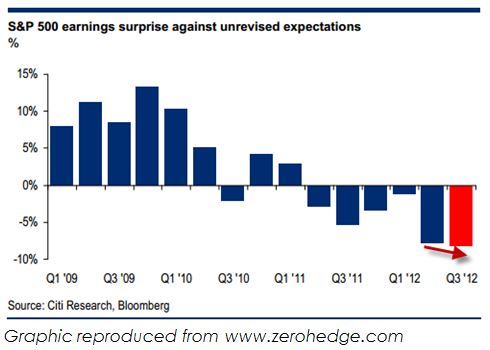

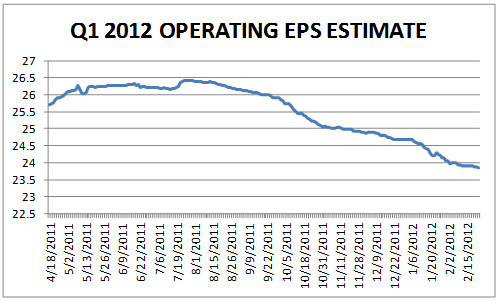

Read MoreMarch Newsletter – Earnings Estimates Dropping

February Market Returns Good news for aggressive investors Aggressive investors were rewarded in the month of February with the Dow Jones Aggressive benchmark returning 4.63% on investor capital. The S&P 500 index, the broadest and most comprehensive measure of U.S. equities, returned 4.32%. International investors did equally a well with the Morgan Stanley Capital International…

Read MoreFebruary Newsletter – Considering Risk When Evaluating Your Investment Options

Adding Measures of Risk to Your Fund Evaluation Picking your funds based solely on performance is a common mistake Return numbers are the most readily accessible pieces of information available to you as an investor. As a result, it is too easy to make fund choices for your 401(k) based on those returns. The level…

Read More