Posts by Jay Jandasek

2012 Year in Review – Battling the Challenges of Markets Unhinged

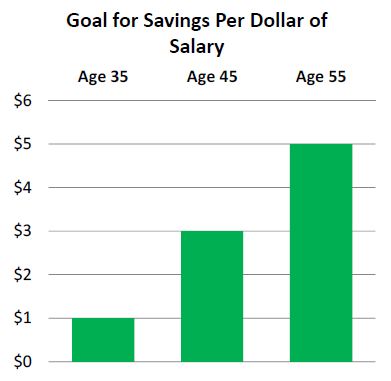

Battling the Challenges of Markets Unhinged We know that retirement plan investors need to focus on the long term performance of their investment portfolios. Changes in strategies, risk profiles, etc. based on short term moves in the market almost always lead to sub-optimal decision making. What we witnessed in 2012 was a complete decoupling of…

Read MoreBeManaged Holiday Hours

We hope you are all getting ready for this fast approaching holiday season! In observance of the holiday season, we will be closed the following days: December 24th – 26th – Closed December 31st and January 1st – Closed We wish you and yours a very Merry Christmas, Happy New Year and Happy Holidays! The BeManaged…

Read MoreDecember Newsletter – Double Digit Stock Market Gains So Far in 2012

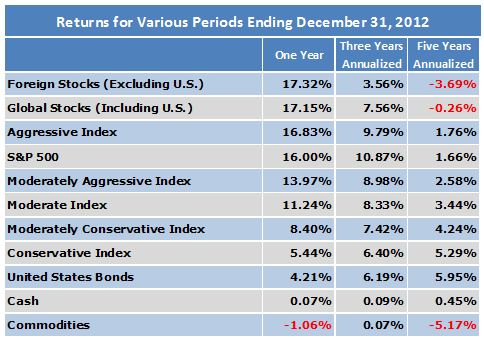

Double Digit Stock Market Gains So Far in 2012 Low Corporate Earnings Growth Offset by Expansion of Price/Earnings Ratio World stock markets bounced back during the second half of November, turning near-term losses into small positive gains for November and for the fourth quarter. Gains were small, but broad-based. Declines were witnessed only in the…

Read MoreNovember Newsletter – Recession in the Works for 2013?

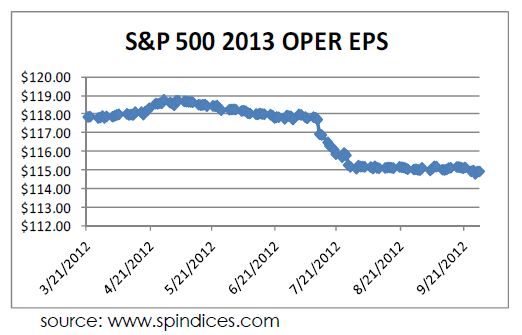

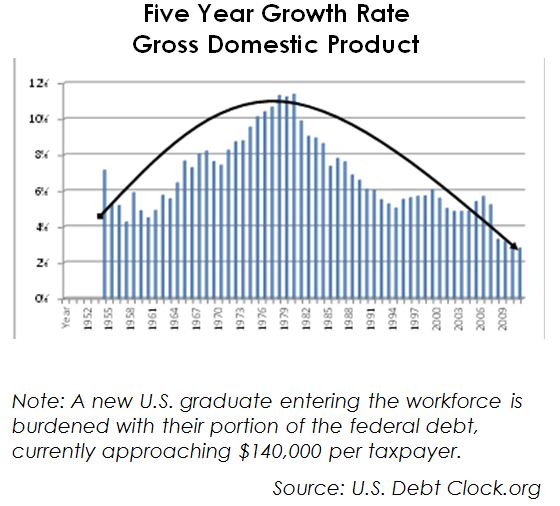

Recession in the Works for 2013? St. Louis Fed indicator may be clue – But what happens to our investments? Information for this article comes from Lance Roberts, www.streettalklive.com, November 6th, 2012, and data from www.stlouisfed.org. Investment professionals are raising red flags over a U.S. Recession Probabilities Index measure available at the St. Louis Federal…

Read More2013 401k Contribution Limits Increase Slightly

Today the IRS posted the 2013 retirement plan limits, and there are a few increases from 2012. The new limits are as follows: Elective Deferrals for 401k/403b/457: $17,500 (increased from $17,000 in 2012) Catch-Up Contributions for 401k/403b/457: $5,500 (no change) Annual Compensation: $255,000 (increased from $250,000 in 2012) Annual Additions Limit for Defined Contribution Plans: $51,000…

Read MoreOctober Newsletter – 2012: A Profitable Year or is There Trouble Around the Corner?

Will the Fourth Quarter Finish off a Profitable Investment Year? – Or is Trouble Around the Corner? Four straight months of positive returns for the S&P 500 have elevated stock prices to near-peak levels for 2012. Large cap stocks in the United Stated gained 2.6% last month, and smaller companies gained over 3%. A five…

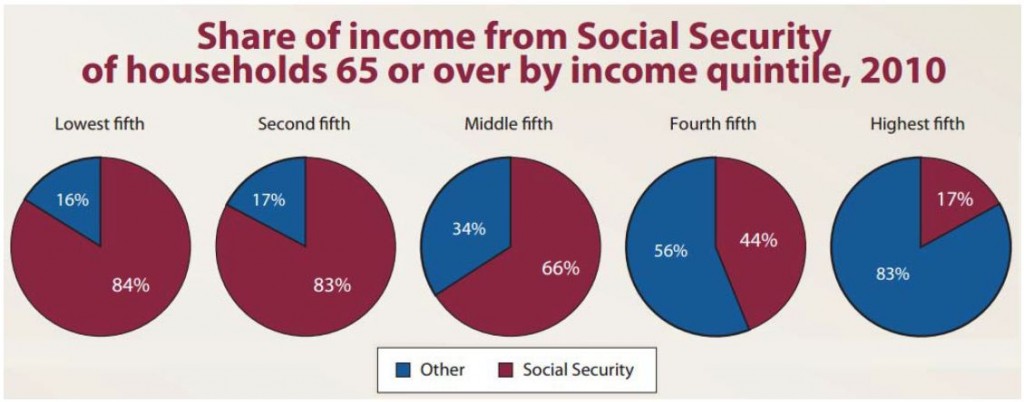

Read MoreSeptember Newsletter – Declines in Median Household Income and the Long-Term Impact on Investment Returns

Three Month Rally Moves Domestic Stock Returns to Double-digits for 2012 The 2% gain in the S&P 500 in August pushed the returns for large cap funds above the 10% mark for 2012. Foreign stock funds continue to lag, returning less than 7%. Surprisingly, bond funds continue to do well in an environment where interest…

Read MoreVideo: Financial Goals Should be Written in Pencil, Not Pen

Our friend Carl Richards of BehaviorGap.com recently posted a video titled, “Do Your Goals Have Too Much Power,” which you can view via the link below. He makes a point similar to a recommendation of one of my favorite radio personalities, Colin Cowherd, makes: When outlining your life, use a pencil, not a pen. I…

Read MoreAugust Newsletter – Is Government Stimulus Really an Economic Stimulus?

What Does Brittany Wenger Have to Do With My Retirement Portfolio? Will continued insistence on borrowing from the capital of future generations lead to a long period of decline? Brittany Wenger is a 17-year-old South Florida resident entering her senior year of high school. Brittany wrote a computer program utilizing artificial intelligence technology to detect…

Read MoreJuly Newsletter – Will More Risk Ever Mean More Reward?

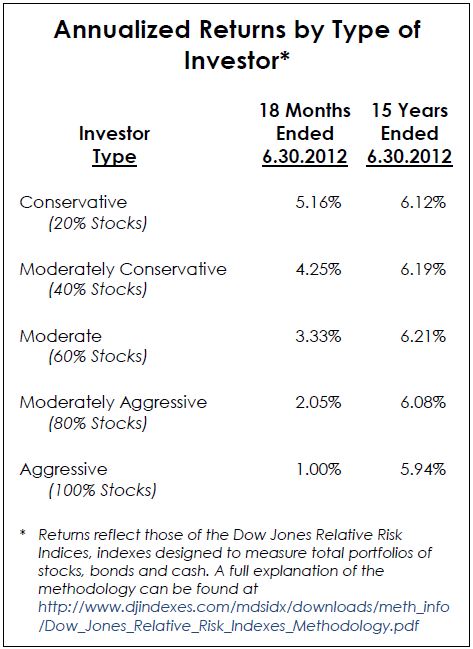

Will More Risk Ever Translate Into More Return? The last Eighteen Months looks the same as the last Fifteen Years Let’s review of the dogmas of the investing world: Over the long run, stocks ALWAYS outperform bonds; The more aggressive you are as an investor, the more you will be rewarded with higher long term…

Read More